The Indian market regulators consist of the following entities.

Cryptocurrency regulation bill – Indian market regulators

In the latest development that is coming from the government of India is the regulation of the private cryptocurrency in India. The government plans to regulate the crypto market in India by issuing its own cryptocurrency and allowing only the legit public players where the ledger of the longest blockchain is public. The official name of the bill is – “The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021″ This is among the 26th bill among the 29 bills in the agenda of the government in the winter session of the parliament in 2021

What is the role of the Indian market Regulators?

The Indian market regulators create a fair, impartial and transparent playing field for all participants. Firstly, if we look at the markets there are three components of any market. They are buyer, seller and regulator. These three players interact with each other in a manner that all the three players are influenced by the activity of each other. This poses a unique challenge to each one of these entities.

SEBI – Securities and Exchange board of India

Firstly, SEBI is the name we often hear on the news channels in India. Secondly, SEBI regulates the market through the Securities, Contracts Regulation act of 1956. Securities include – shares both listed and unlisted, bonds, debentures, commercial papers etc. The apex Indian Market regulator in the equity market is SEBI

- Offers investor protection

- Establishing quality institutions

- Create a mechanism of redressal – SCORES

SEBI was established via the Securities and Exchange Board of India Act 1992

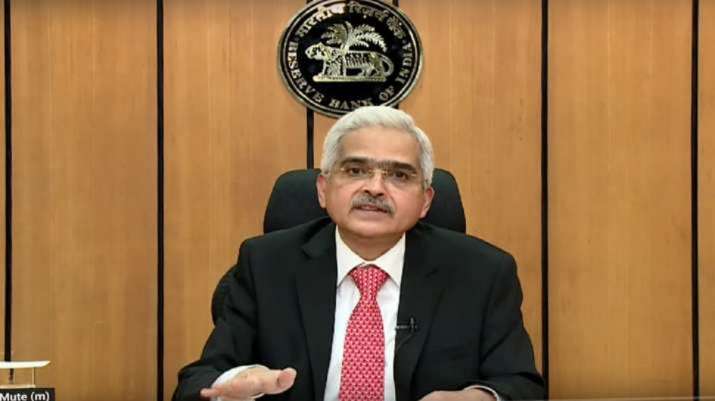

Reserve Bank of India RBI

The Reserve Bank of India is the apex bank of the country often referred to as the central bank of India. However, we have another bank by the same name. RBI is an Indian market regulator. In order to operate in India, any bank has to take permission from the Reserve Bank of India. There following are the functions of the Reserve Bank of India or RBI as the Indian market regulator.

- Granting of Banking Licenses

- Issuer of government securities

- Issuer of Currency notes in India

- Banker to the government of India

- Issuing Monetary policy

- Lender to central and state government

There are many functions that are undertaken by RBI but our focus is only on those that are relevant. Firstly, a person cannot participate in the market without having a bank account. Secondly, a pan card issued by NSDL is necessary for depository account opening in India. Therefore we can conclude that every action of RBI affects the stock markets.

Ministry of Finance

The Ministry of Finance – Government of India regulates the Indian markets through the Department of Economic Affairs. However, the Ministry does not play an active role in dealing with the regulations pertaining to securities in the market. Much of this power is bestowed in the hands of SEBI.

Sector Specific Indian Market Regulators

There are many sector-specific regulators in the securities markets.

- IRDAI – Insurance Regulatory Development Authority of India

- PFRDA – Pension Fund Regulatory Development Authority of India

- AMFI – Association of Mutual funds of India

- CDSCO – Central Drugs Standard Control Organisation

- DGCA – Directorate General of Civil Aviation

and so on for every sector, there is a regulator in India. There are no central clearances and therefore India ranks low in the ease of doing business report published by the World Bank but the new reforms are kicking in. Finally, we will see some improvement in the rankings in the coming years.

Ministry of Corporate Affairs

Firstly, the Ministry of Corporate Affairs has nothing to do with markets but then if we observe closely it has everything to do with markets. The formation of companies is governed by the companies act of 2013. Secondly, companies are the essence of markets. Therefore the MCA is also an important ministry in deciding the category, definitions and domain of functions of a company in India.