The first question that comes to mind when we read the word GREEN HYDROGEN is what is green hydrogen? Firstly, Hydrogen is the first element of the periodic table. Secondly, hydrogen is highly reactive. Finally, the sun we see is emitting light as a result of the Hydrogen Fusion reaction.

Hydrogen is the ideal fuel because it reacts with oxygen to produce water and release energy. The only problem is to control the reactivity of hydrogen and make it safe for public use.

Definition of Green Hydrogen?

The hydrogen that is derived from renewable sources of energy is known as Green Hydrogen.

Types of Hydrogen

There is an entire spectrum of colours for hydrogen. Firstly, hydrogen is colourless gas but colour-coding is done in order to identify the source of energy that produces hydrogen. Secondly, hydrogen is produced from the electrolysis of water.

In order to break the water into hydrogen and oxygen, a large amount of energy is required. Therefore, the source of energy became the basis of colour-coding.

Colors of Hydrogen based on energy sources

- Green – Renewable Sources

- Yellow – Mix of fossil and Renewable or Solar

- White – Naturally occuring in geological formation, uderground deposits

- Pink – Electrolysis using Nuclear power

- Brown – Brown coal

- Black – Black coal

- Turquoise – Methane pyrolysis

India’s first Green Hydrogen power plant

The IOCL (Indian Oil Corporation Limited) a publicly listed PSU – Public Sector Undertaking has announced the setting up of India’s first Green Hydrogen power plant at its Mathura refinery UP. The share price of IOCL on 1 August 2021 is at 103 Rs

Significance of IOCL’s Green Hydrogen power plant

IOCL is part of the Nifty 50 index and is a large-cap Indian PSU company. Firstly, by making this announcement IOCL has given a direction to the future trajectory of the company.

Secondly, this news should be a wake-up call for the automobile industry that electricity is not the only fuel option.

Thirdly, this announcement will help in boosting the share price of IOCL

The monthly chart of IOCL is showing a trend reversal. If IOCL is successful in transitioning from fossil fuels to the Green Hydrogen economy it can be a game-changer.

Valuations of IOCL

Firstly, IOCL operates in a strict regulating environment. Secondly, the market cap of Indian oil corporations is just Rs 97,154.12 Cr. Highlighting the market cap is significant because IOCL has a revenue of 5 times of Market cap. The following figures will show us how IOCL is trading at discounted valuations.

- Revenue – 5.86 Lac Cr

- Profit – 24 Thousand Cr

- Debt – 1.29 Lac Cr

- Cash – 10.5 Thousand Cr

Note : The net profit is 24 K cr which is not even 5% of IOCL’s revenue. Had IOCL been a private company its position would have been different. There is also significant debt on the company.

Consequently, if we analyse IOCL carefully then we will know that Rs 103 is not its actual price as per valuation. According to ticker-tape current dividend yield is 11.35%. An investment of ₹1,000 in the stock is expected to generate a dividend of ₹113.45 every year

The P/E ratio is – 3.81 and the P/B ratio is 0.82. According to warren buffet if a company’s P/E is below 10 and P/B is below 2 then an intelligent investor should make a careful assessment of the company. Because this decision can change his/her life.

IOCL Outlook

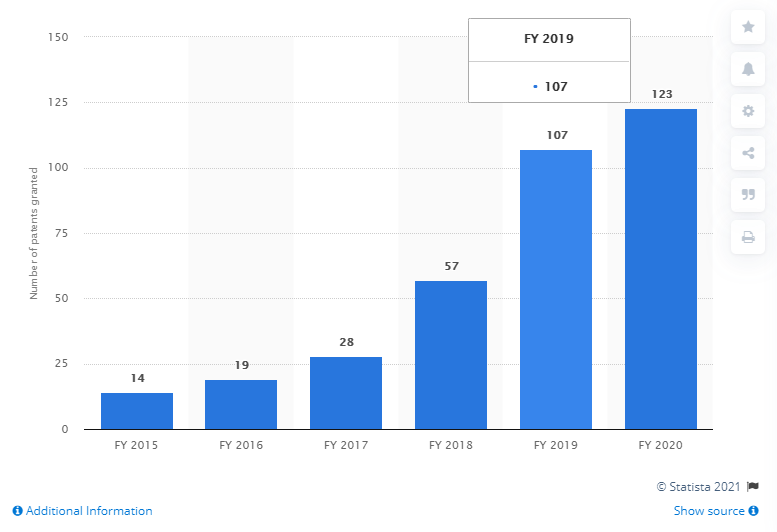

Firstly, the IOCL outlook looks good from here. The company as of 2019 had more than 1000 patents in their name. Secondly, the R&D team of IOCL is very strong. According to Statista IOCL applied for 123 patents in 2020.

India’s fuel demand will rise from 25 million tonnes to 400 to 450 million tonnes by 2040. As a result of which various forms of energy can exist. Although it’s difficult to predict how the future fuels will look like ethanol, LNG, H-CNG, CNG, Biodiesel, Hydrogen and Electricity.

The only drawback with IOCL is the badge and baggage of being a PSU – Public Sector undertaking. The government’s intervention in the working of the company and strict regulatory framework drive away potential investors.

Hydrogen Storage

There is a technical difficulty in storing hydrogen. The challenge is to compress, liquefy and keep its temperature at -253 degrees centigrade. LNG can be liquified at -163 degrees. The production cost of green hydrogen is considered to be a prime obstacle. Currently, the production cost of green sources of energy according to IREA – International Renewable Energy Agency is $1.5.

Presently less than .01% or say 75 million tons/year of hydrogen capable of generating 284 GW of power, is being produced.