To begin with there are many types of candlesticks for analysing security prices. A candlestick is a useful tool for anyone analysing securities that are dependent on price, time and volume – PVT. Therefore, in modern-day trading & security analysis studying candlestick patterns becomes extremely important. Almost all analysts use candlesticks because candlesticks are applicable to all asset classes. Candlesticks are asset independent. Therefore a candlestick chart can be drawn of any entity that is dependent on PVT.

What are the characteristics of the candlesticks?

Firstly, candlesticks are a Japanese invention, read more about candlesticks used by Japanese rice traders. A single candle has four attributes. They are open, high, low and close.

Body – The difference between the open price and the close price is the body of a candle.

Shadow – The difference between the high price and low price is known as the height of the candle. Heigh – Body = Shadow

Colors used in Candlesticks

Firstly, there are two different types of colours that are used to represent a candlestick. Secondly, these two colours can be any colour of your choice. Finally, it’s green and red that wins the race in most cases. The green represents buying and red represent selling. If you don’t know what are the 3 types of market trends then you can read here

Buying = Bull market = Uptrend = Green Candlestick = Open price > Close price.

Selling = Bear market = Downtrend = Red Candle = Close price > Open Price

What are the types of candlesticks?

There are many types of candlesticks but for simplicity, we will categorize them into 3 categories.

- Long candlesticks represents strong sentiments

- Medium sized candlesticks mild sentiments

- Small sized candlesticks state of indecision

Long Types of Candlesticks

To begin with, we have Marubozu as our first candidate. It represents strong buying action if the candle is green and strong selling action if the candle is red in colour.

Morubazu is all muscle – full body and no fat – no shadow. An In-dept explanation of this candlestick is provided on Varsity by Zerodha in both Hindi and English.

In short, Morubazu represents extreme or strong sentiments in the market.

Medium Types of Candlesticks

Firstly, there are lots of medium-sized candlesticks but they are of no use. Because these candlesticks do not represent any type of market trend. A candle with a bigger body size but smaller than Marubozu will fall under the medium types of candlesticks. Their formation aid in the continuous propagation of trends. Medium size candlestick helps in forming a continuous pattern.

Short Types of Candlesticks

Short candlesticks are a traders delight! Firstly, short size candlesticks represent a state of indecision in the market. Secondly, they can be analyzed along with the trends in which they appear.

Short candles in Uptrend

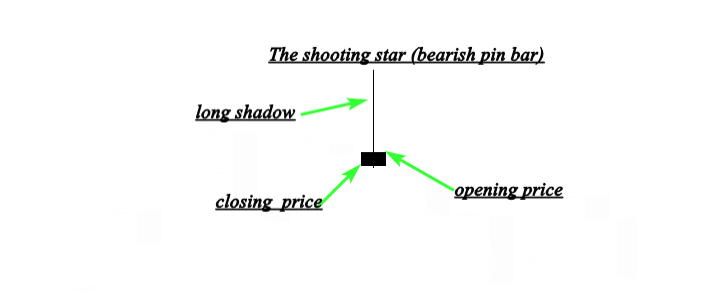

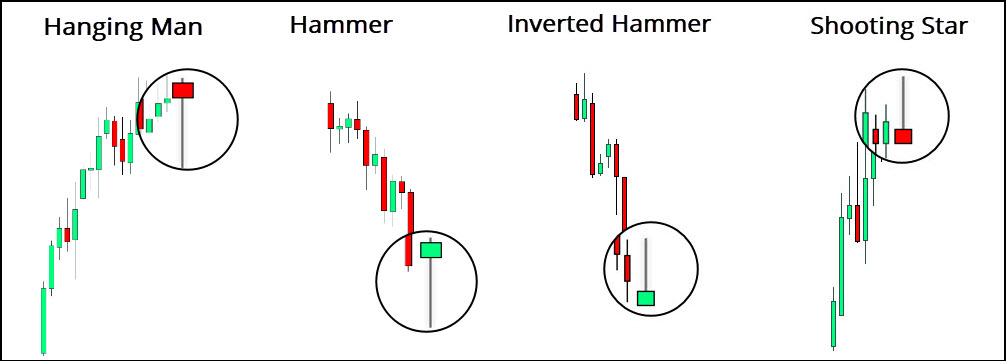

- Shooting star – A long tail and a short body

- Hanging man – A last candle in an uptrend. Exactly opposite in shape of shooting star. In the downtrend hanging man is known as a hammer.

- Hammer – The shape of the candle is like a hammer, the candle is smilar in shape to hanging man in every way. But hammers are formed in the downtrend and helps us in predicting trend reversal. In the uptrend hammers are known as hanging man

- Doji – A very thin body and small shadow candlestick. Read more about Doji on IQ Option

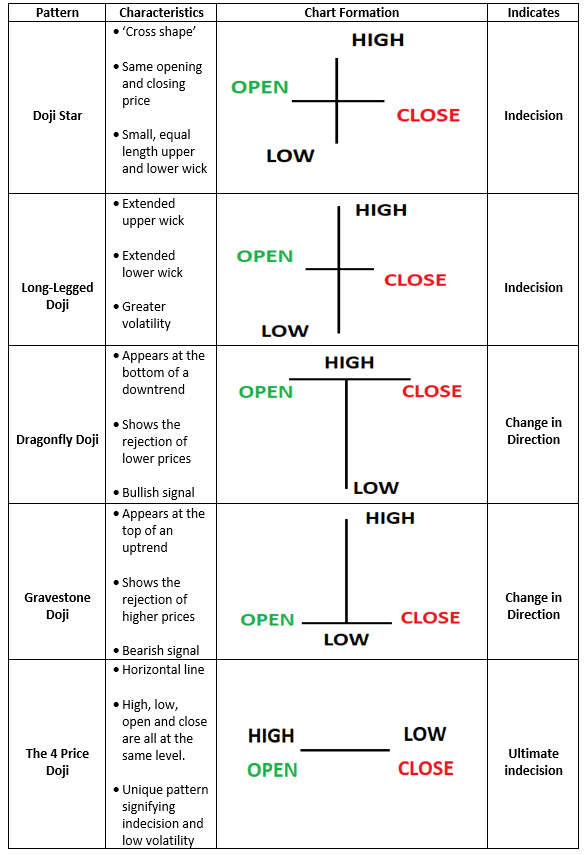

Types of Doji Candlesticks

Dojis are the indicator of indecision both in the uptrend and the downtrend. The image below uses the term wick which is nothing but the shadow.

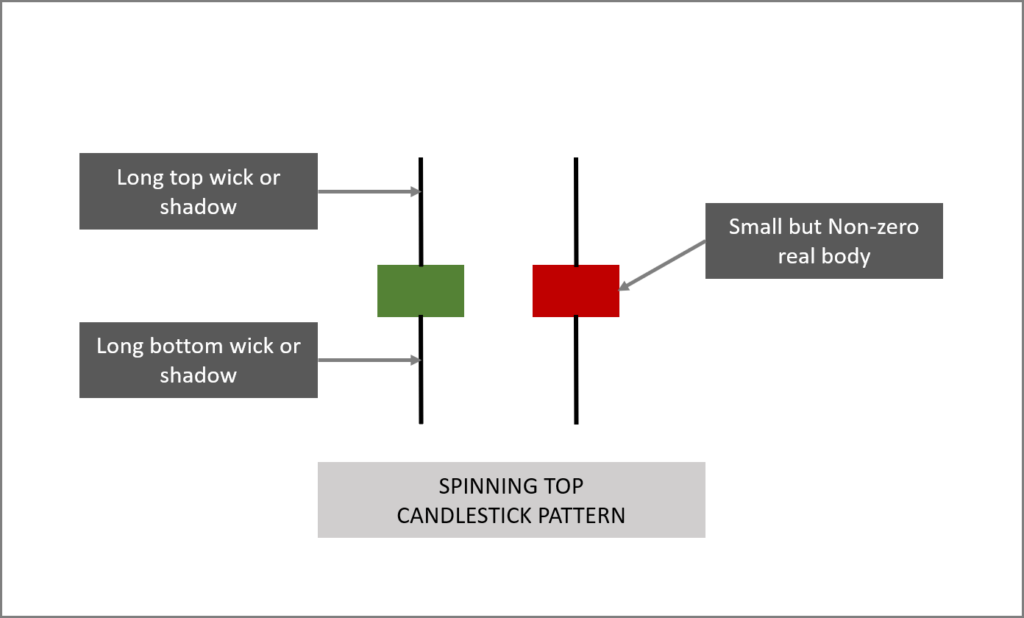

Spinning Tops

- Spinning tops – A coninuous chain of dojis or small body and small shadow candlestick. A chain of dojis and hammers in the up and down trend represent spinning tops.

- Spinning tops are a form of dojis with a small visible thick body. The continuous formation of spinning top depicts a state of prolonged confusion.

Bearish Harami or The Inside Bar

- Harami – The name Harami in Japanese language means “Pregnant women”. In this pattern a small candle of opposite color of the previous long candle is formed. Thereby indicating trend reversal in both uptrend as well as downtrend.

Trend Reversal Types of Candlesticks

As can be seen from the image below. Shooting stars and hanging men are formed at the top of the trend and are usually followed by selling.

Conclusion

In this article, we have seen the following candlesticks

- Marubozu

- Hammer

- Hanging man

- Shooting star or Inverted Hammer

- Doji

- Spinnig tops

- Medium sized candles as a buffer

Candlesticks aids in our decision making and market interpretation but these are not absolute in nature. Therefore we will also study other cues to refine our decisions.

Firstly, we have seen single candlesticks now its time to look at muliple candlestick patterns