Welcome to Lrnin – Your Gateway to Practical Learning

Learning is a lifelong journey, and you’re in the right place to accelerate your understanding with minimal effort. At Lrnin.in, we believe in maximizing the value of knowledge with concise, impactful insights. Our motto is that if you’re a student of something. We believe in the age of AI that content, education & learning should be free. Therefore our focus would be first on financial literacy, then we will target education and exams.

To have financial literacy first we should understand the role of the trinity of fundamentals: Power, Skills, and Time. When you learn to master any of these, money follows naturally. This platform explores these foundational pillars in-depth—and how they connect to financial literacy, success, and decision-making.

Understanding Power, Money, and Time

Why Learn About Power and Money?

Knowing the true nature of power and money helps us make rational decisions and accept outcomes with clarity. Power creates money; money only supports power. It may mimic power but lacks true authority unless supported by strength or influence.

🔍 Example from Hindu mythology:

Lord Vishnu (symbolizing power) and Goddess Lakshmi (representing wealth) together show the synergy—where true wealth follows real power.

What is Power?

Power is the ability to act, influence, and lead. It can be achieved through:

Leadership

Merit

Skills

Fairness

Strength

Dedication

Discipline etc

True power is earned and sustained—not bought.

What is Money?

Money is a human-made agreement to exchange value. Unlike the universal barter system found in nature, money is uniquely human and evolves with society. It works based on demand and supply and takes various forms—cash, digital assets, bullion, and more.

What Role Does Time Play?

Time is the context in which power and money operate. Over time, these elements shift, evolve, and change hands. Understanding time helps us make sense of economic cycles, investment decisions, and life transitions.

Ideally, it is better to analyze the concept of money before understanding investment. Take it a step further and analyze Power, Skills, and Time before money & the entire picture falls into place. Learning all of this is necessary if we want to know & master our decisions.

Money can only be understood by humans because we have created it. All creatures on the planet understand actions, rewards, and risks. Money becomes the medium of exchange that is valid while exchanging goods, investments become positively fair and time-bound exchanges, savings become part of money earned and preserved, and bad decisions/actions become risks. This sort of classification is broad in scope and there might be nuances and exceptions. By and large, understanding it this way provides a strong foundation for learning key concepts as it encompasses most practical life situations & economic models barring exceptions.

Investment is a very small portion of the money cycle but all of us are bound by it as if it is forever. Let us look at this small but crucial aspect of money. The inherent characteristic behind doing something with our savings is the act itself. We cannot contain our incessant urges to act because we are brought up in that manner or we can say that our mind constantly makes decisions. Therefore when we see something idle we tend to put it to good/bad/any use that yields something in return. This something can be tangible as well as intangible.

Financial Literacy: From Basics to Mastery

Life Stages and Financial Priorities

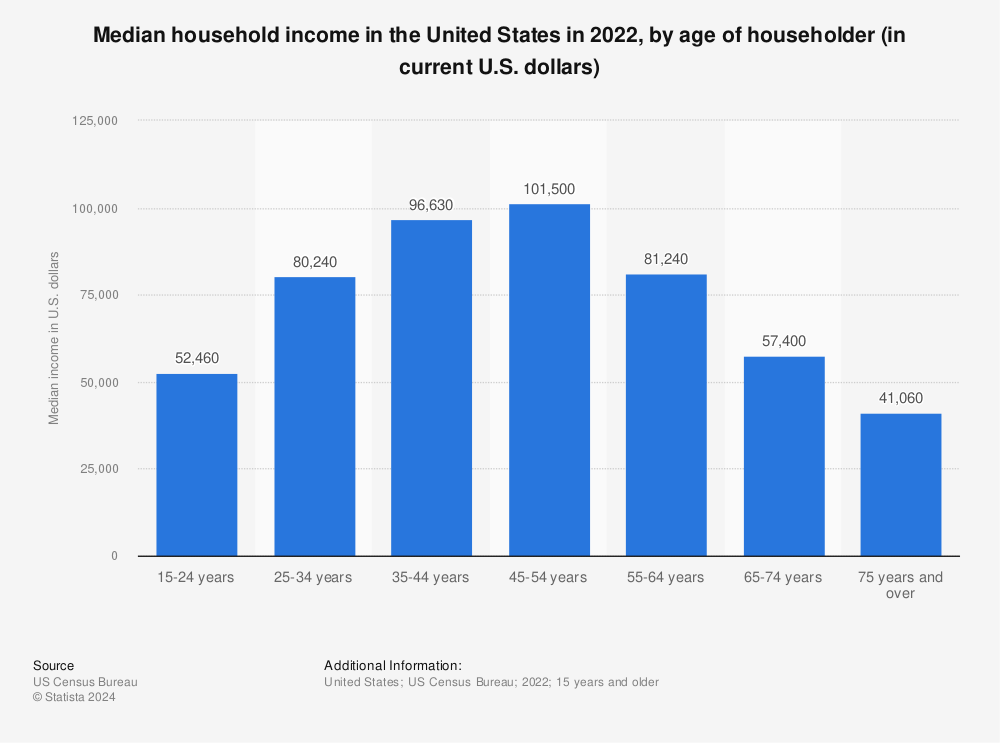

Understanding where you are in life helps set financial goals.

| Age Range | Life Stage | Financial Role |

|---|---|---|

| 0–20 | Dependent | Learning & Observation |

| 20–40 | Independent | Skill-building & Income |

| 40–60 | Responsible | Saving & Investing |

| 60–100 | Dependent Again | Managing Assets |

✅ Working age: 16–65 years

✅ Peak earning phase: 25–55 years

Income, Savings, and Wealth

Formula:Total Income – Total Expenditure = Savings

Savings are your most important asset. They enable:

- Independence

- Stability

- Future investment

- Risk management

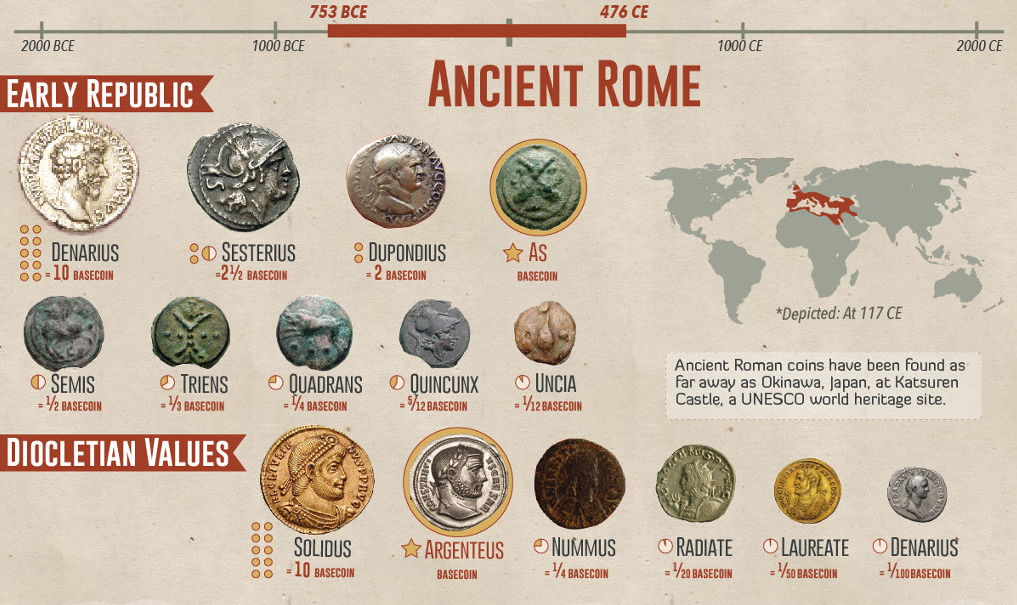

The History and Evolution of Money

From Barter to Blockchain

- 10,000 BC: Humans stored grains for the future – An early form of savings

- Barter system: Based on the double coincidence of wants

- Ancient money: Gold, silver, and other precious metals acted as universal currencies

- Modern times: Central banks issue currencies backed by trust and economic strength

🧠 Insight: During crises, bullion holds more value than paper currency.

Income is not a solitary act. It requires time, patience, skills, learning, and practice. All of which create an ecosystem of people and productivity. Life is divided into stages at an individual level. However, in groups or communities, individuality has no existence. A group collectively behaves as an individual. To know how we unanimously came to this point or this system where we have to interact with other people to live a good life is of utmost importance to us. The study of our past is known as History. To understand our past we need a skill called Reading.

There is a very old adage and that is “History repeats itself”. To know the probability of what will be repeated in the future we have to read the past.

Learning about Savings

The concept of savings dates back to 10000 BC when humans began the practice of farming. The saving for the future was done by storing grains in pots & granaries. This also led to the development of pottery. In modern times pots can be equated with banks. Banks hold money but they are also engaged in activity that lead to creation of money.

Slowly settlements began to exchange goods within themselves & with other settlements. This system of exchange of goods was called the barter system. The barter system worked on the principle of double coincidence of wants. This restricted the scale of exchange or trade. However, trade continued in relatively small quantities based on the needs. As the population increased this activity picked up the pace.

To overcome this hurdle (the double coincidence of wants) the mathematical concept of Money was invented. Money always has an issuer be it ancient times or modern times. An issuer is always a powerful person, entity, institution, or nation. In earlier times whenever the issuer of the money became weak due to any reason. The money took the form of a precious, scarce, limited natural resource that is durable, valuable & universally acceptable. Hence we see bullion metals like Gold, Silver, and Platinum taking the form of money. An important learning from this paragraph is that during a time of crisis, bullion will have more value than other forms of money.

All of this resulted in, trades that were bigger in size can be executed & settled easily. It is important to know all this to expand the scope of our learning. Money derived its purchasing power from the issuer, and the exchanges, the issuer is usually a powerful person or institution or a country. Since there were many issuers in the past like we have many currencies today. It created a unique problem of standardization of money. Gold was used to overcome this problem.

In peacetime and in times of prosperity, anything can acquire the form of money if the issuer is powerful and strong enough to win the trust and enforce the obligation that comes upon issuance and circulations. The relative strength of the issuer gave rise to a system of currencies in modern times.

For efficient utilization of savings, we can split the savings part into two major components. This financial learning is important for every individual.

- Investments = Acceleration

- Insurance = Brakes

Investments can be risky and an individual investor can choose the risk. Highly risky activity includes trading time-bound contracts or new financial products such as cryptocurrencies. Trading and Investing are the activities of an investor. These activities are undertaken by an investor in financial instruments or Assets prepared by regulating agencies.

Learning about Insurance Products

It is very important to learn about insurance products. Insurance is a vast industry that works on the concept of risk pooling. Therefore it becomes important for us to learn about insurance products. There are two types of insurance.

- Life Insurance

- General Insurance

Free learning content

The objective of this material is to impart free and correct knowledge to the reader. Learning about different aspects of life is important to improve the chances of getting success in life.

- What is the structure of Financial Markets?

- What are the different types of assets? There are a number of them and it is important for us to review these assets to our advantage.

- Types of Financial Investment products available in the markets?

- What are the regulating bodies in the Indian Financial Market? To have an in-depth understanding of the Indian markets it is of utmost importance to have an understanding of the regulatory framework of India

- How can you address Financial fraud? A lot of people are afraid to even enter the securities markets as they are unaware of the redressal mechanism at their disposal.

- Why keep all your eggs in different baskets – Risk Management? Finally when we are entering into the market then “diversity seems to be the best policy to mitigate risk“

- What are bonds? How to invest in them?

- How do trading in Equities, Commodities, Currencies, and Cryptocurrencies, and their derivative products like futures and options?

A systematic study will help an individual in the formation of the correct perceptions and analytical skills. The publicly available data will help us in simplifying the markets. It will also improve our ability to spot discrepancies. Therefore before an individual jumps into the stock/share/financial markets, they should know the answers to some of these questions related to the markets.

Learning to Trade

Trading is both technical and tactical. One has to be careful of the risks involved. Therefore we will study the below-mentioned topics before starting to trade. Our study will help us in dealing with the markets. All this will give us a brief idea of the setup requirements for handling our investments. Finally, this exercise will also set out our expectations of the returns. The absolute returns a person generates from the markets will depend on the skills learned from this website and other online sources. Trading purely relies on candlestick patterns and indicators, partly on fundamental analysis and news.